MTS News

MTS Economic News_20180119

· The U.S. dollar fell on Thursday as traders piled into the euro, yen, sterling and other major currencies, prompted by concerns over a possible U.S. government shutdown as lawmakers struggled to cobble together a federal budget deal.

If an agreement to fund government operations, even a temporary one, is not reached by the Friday deadline, it would compound an already negative climate for the greenback, analysts said.

At 2:44 p.m. (1944 GMT), the trade-weighted dollar index =USD was down 0.44 percent at 90.513. It held above a three-year low of 90.104 touched on Wednesday.

The euro hovered below its three-year peak against the greenback. It was up 0.48 percent at $1.2242.

The dollar was down 0.23 percent at 111.02 yen, while the pound was up 0.45 percent at $1.3888.

· U.S. government debt yields rose Thursday after the Labor Department said that the number of Americans filing for unemployment benefits fell to the lowest level in 45 years.

The yield on the benchmark 10-year Treasury note rose to 2.611 percent at 2:51 p.m. ET, while the yield on the 30-year Treasury bond rose to 2.887 percent. Bond yields move inversely to prices.

Earlier, the yield on the benchmark 2-year Treasury note hit 2.06 percent, its highest level since Sept. 2008, when it yielded as high as 2.128 percent. The 10-year note yield hit 2.62 percent, its highest level since March 2017.

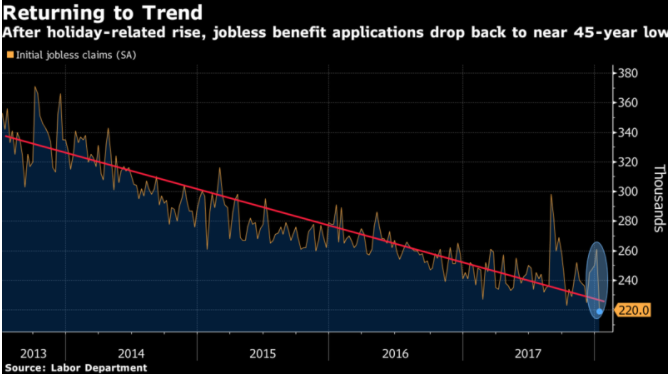

· U.S. filings for unemployment benefits plummeted to the lowest level in almost 45 years in a sign the job market will tighten further in 2018, Labor Department figures showed Thursday.

Jobless claims decreased by 41k to 220k (est. 249k); lowest level since Feb. 1973, biggest drop since April 2009

Last week marked the 150th straight week that claims remained below the 300,000 threshold, which is associated with a strong labor market. That is the longest such stretch since 1970, when the labor market was much smaller.

· The U.S. Federal Reserve should raise interest rates about three times in both 2018 and 2019, Cleveland Federal Reserve Bank President Loretta Mester said on Thursday, a pace that is a bit faster than many of her fellow policymakers prefer.

Fueled both by consumer and business spending, the economy should grow at about a 2.5 percent pace this year, though the recently passed tax cuts could drive growth even faster and will continue to provide a lift to the economy next year as well, Mester said.

Unemployment, now at 4.1 percent, will sink below 4 percent by the end of the year, and inflation, now below the Fed’s 2 percent target, will return to goal within a year or two, she forecast.

“If the economy evolves as I anticipate, I believe further increases in interest rates will be appropriate this year and next year, at a pace similar to last year’s,” Mester said in remarks prepared for delivery to the Council for Economic Education in New York.

· U.S. House Republicans said late on Thursday they had made progress toward passing a short-term extension of government funding to avert a politically embarrassing shutdown, after a day of tough negotiations and confusion when President Donald Trump offered mixed signals on the stopgap plan.

Trump complicated the talks by saying a six-year extension of funding for the Children’s Health Insurance Program (CHIP), a Democratic priority, should not be included. The White House later said the president fully backed the proposal pending in the House of Representatives, which includes the insurance plan.

· The U.S. House of Representatives on Thursday passed a bill to fund government operations through Feb. 16 and avoid agency shutdowns this weekend when existing money expires.

The bill still must be approved by the Senate, where it faces an uncertain future.

· Former prime minister Silvio Berlusconi and his rightist allies agreed on Thursday to a joint manifesto ahead of a March 4 national election, committing themselves to cutting taxes and rolling back pension reform.

“United we win,” Berlusconi wrote on Twitter, announcing that he had signed the electoral program along with Matteo Salvini, head of the anti-immigrant Northern League, and Giorgia Meloni, leader of the nationalist Brothers of Italy party.

· Oil was little changed on Thursday, as prices eased early in the session, but were supported by a record drawdown of U.S. crude stockpiles at the Cushing, Oklahoma delivery hub.

The market remains wary that OPEC-led output cuts will trigger price hikes that will increase supply from the United States.

Brent crude, the global benchmark, settled down 7 cents at $69.31 a barrel. On Monday it touched $70.37, the highest since December 2014. U.S. crude was down 2 cents at $63.95, having hit its highest since December 2014 on Tuesday.

Reference: Reuters, CNBC